To get a PAN Card in Nepal, visit the IRD website (https://ird.gov.np/) and fill the online application form with necessary details and upload required documents, such as a scanned copy of your citizenship card, passport (if applicable), and a recent passport-sized photo. After submitting your application, track your status using the provided tracking number and, if accepted, visit the IRD office to receive your physical PAN Card .We will look in detail about the requirement and who and how they can get pan card in brief below.

So you are looking for getting a PAN Card (Personal Account Number ) , here is the detail guide on how you could apply for pan card both online and offline methods to get one .Also this article guides and let you know the prerequisite for the pan card application if you are eligible for application on PAN Card process or not .

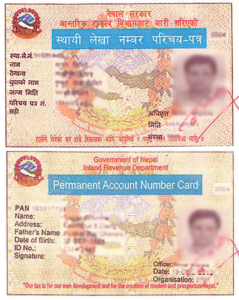

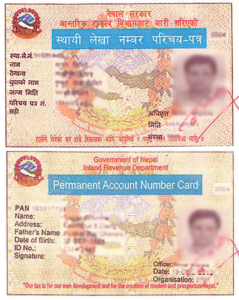

PAN (Personal Account Number) is a unique id number for the taxpayer individual provided by government .Its a legal verification card with personal details and a photo and a pan number to represent the tax history of that individual. It is used by IRD in land revenue department for the tracking an identification of Taxpayers of Nepal. The pan contains a unique number for each entities either the business or an individual person with 9 characters generated by the system of Inland Revenue Department (ird)

Different Types of Pan Card

PAN Card are of different types and can be obtained for an individual to business entities , employees and companies.

Individual PAN Card is issued to a individual to represent themself in the tax system of Nepal. It helps to manage their tax details such as legal name , address and tax identification number.With this an individual can easily manage and keep track of tax-related transactions (like income , expense and payments)

On the other hand Business PAN Card is issued to a business entities partnerships, or other commercial entities or an company to represent them in the tax system of Nepal. It is same as individual pan card but for the business entities or company.It is for the purpose of business tax payments , financial record-keeping and reporting of business transaction , income and expense.The card contains business name , identification number and other relevant informations related to business.

Who are applicable to register a PAN Card

Any one who are involved in professional financial transaction activities or requiring to pay tax for are eligible to get a pan card.Below are the entities or individuals who are eligible and need to get a pan card

Individuals

– Any Salaried , self employed or Non Resident Nepali NRN who are earning either working on offices or as a freelancer , contractor or the NRNs having financial transaction in Nepal are required to have a PAN Card

Business/Organization

– Companies either public or private , partnership firms , business owners ,Non profit organization NGO who are involved in financial transaction in Nepal on behalf or these included entities are required to have a pan card.

In short anyone involved in earning income , business transaction and are involve in finantial activities in nepal are required to have a PAN Card

How To Get Pan Card From Online Process

Obtaining a PAN Card through online process have minimized to be present physically in the office and shorten the process of getting pan card .It is done throught webiste submitting details and apply for the pan card .

Step 1 : Visit the Website of IRD

IRD Nepal have an official website for services related to the tax payment and information and notices . Webiste https://ird.gov.np/ is the government website for the services related to taxpayment and information related to their service .Go to the website for the registration of you Pan Card

Step 2 : Click on New Registration for PAN

Fill the necessary form details on the provided fields as per the legal documents you have (the national identity card) .Carefully read all the form fields and fill with the respective details of yours. You need to provide Informations like your full name , date of birth , citizenship number , legal address , contact details like your phone number and emails , your employee status (for individual ) or business details (for business entities)

Step 3 : Provide necessary documents

After filling the necessary details you will be prompt to upload documents int the upload field .For business and individual you will require different documents .

For an individual you may be prompt to upload an scanned copy of your citizenship card / passport (if you ar NRNs ) and recently clicked passport size photo of yours (the photo should be clear and also your eyes , ears and face should be seen from front view and with out external accessories like random hats , glasses or masks etc) and a proof of your address it can be your bank statement or any legal payment bill like electricity or water bill and must specify your clear address .

For an business you may upload additional documents related to your business like it could be business registration certificate, proof of your business operating location or other related legal documents related to your business.

Step 4 Review and Submission

You will be given an summary of your details and document you have uploaded in the form .Review and double check each field and ensure are correct and as per the legal document .Then hit the submit button and you will be given an tracking number which is used to track the progress of your form .

Step 5 : Track and Obtain Your Pan Number

You can keep track of your application using the number and provide the status of your application .Keep on tracking your application regularly and after few working days your application will be accepted or rejected .If your application is accepted then you will be provided with an pan card number .You have successfully created an digital instance in tax system of Nepal .You can use it wherever necessary for tax services with the number .

If your application was rejected and it will be provided with an error message .It could be because of wrong details provided by you .Read carefully and fill form again to resubmit he application.

Step 6 : Physical Card Issurance

In order to get an physical document your need to provide an online application form/application printed /scanned copy to the ird in hand. You must visit the IRD office to the applicable office and then submit the documents (you may require to bring a copy of citizen ship , two passport size photo and other legal document for identity verification) and it goes through validating the application and once verified you will be given a PAN Card .

This is the process of Registration Process of pan card document through online medium. I hope this article helped you in getting an pan card for you business or an personal card .If any confusion related to process comment down below with queries.